Every investment has some risk. The investment risk is defined as the probability that the yield is lower than expected.

On average, riskier investments tend to have a higher yield, in the long run. Some investors are willing to accept a higher volatility, to receive a higher average return.

For example, an investment with low risk and low return are *Short Term US Treasury Bills. T-Bills, are low risk investments, since they are backed by the U.S. government. But their return is also very low.

Stocks prices, on the other side, have a higher volatility. But the long term average return is much higher. Take into account that we are saying long term average. In the short term, months or years, stocks indices can have negative returns. Also, individual stocks can also have negative returns.

Loans to companies have a higher risk than loans to the government. Loans to individuals have a higher risk than loans to companies.

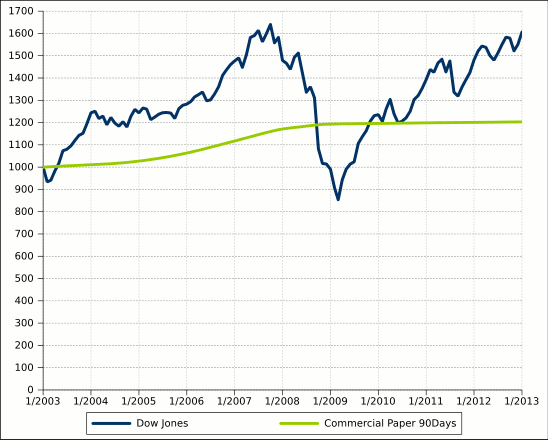

In the following chart we can track the evolution of a diversified investment in stocks, according to the Dow Jones index, and the evolution of a deposit in a commercial bank.

The blue line represents the investment in stocks. The volatility is higher. If you invested in the Dow Jones at the beginning of 2007 and sold your stocks at the beginning of 2009, you had had a significant negative performance.

The green line represents an investment in a commercial bank deposit. This investment has a lower risk and did not have a negative yield.

But on the long run, the yield of the stocks is higher than the yield of the bank deposit. This relation can be observed almost every time we consider a long time frame, for example, 10 years.

Types of Risk in Investment

Credit risk: when the borrower doesn’t have the funds to repay. It happens when a business or individual has earnings that are lower than expected. For example, if a person takes a loan and then loses his job.

Inflation risk: when the inflation rates is higher than expected. If the nominal yield is 10% and the inflation rate is 15%, the real return rate is negative.

Currency risk: caused by the volatility of the exchange rates.