Foreign Direct Investment

Foreign Direct Investment is the investment of funds by people or companies of a country, in real assets of another country, with the purpose of obtaining profits in the future.

For example, if one company located in country A, buys another company, located in country B.

Categories of Foreign Direct Investment

- Creation of a new company: when a company creates a new company abroad.

- Purchase of a company: when a company purchase another company located abroad, or a share of the latter.

- Mergers: when 2 companies, located in different countries, join and become one.

- Utilities reinvestment: when a subsidiary company that belongs to a company located in another country, invests the profits in the country that is located. The subsidiary company doesn’t send the profits to the parent company.

Foreign direct investment entails active management of foreign companies. It can also lead to technology and knowledge transfers, usually from the parent company to the subsidiary.

The influence in the management of the subsidiary can occur in the following ways:

- appointing managers

- establishing the subsidiary policies

- endorsing or not important decisions

- etc.

Classes of Foreign Investment

Horizontal

When the parent company engages in the same economic activities in the host country. For example, if a car manufacturer builds a car factory abroad.

There can be differences between the home manufactured cars and the cars made abroad. For example, Peugeot cars made in Brazil have less security features than Peugeot cars made in France.

Some motivations of horizontal foreign direct investment are:

- to take advantage of competitive advantages of different countries

- to serve differentiated products to different markets

- to avoid customs tariffs

Vertical

When only a portion of the productive chain takes place abroad.

For example, if a car manufacturer builds gearboxes abroad; then imports and assemble them to the local made cars.

Using vertical FDI, companies can take profit of comparative advantages of different countries. In many cases, labor intensive activities are located where wages are lower. For example, some US manufacturing firms are producing parts in Mexico and then importing them to the US.

Effects of Foreign Direct Investment

FDI can transfer technology and knowledge between countries.

In the short run, it generates a flow of capital from the originating country to the host country. This flow can cause a currency appreciation in the host country. If utilities are sent back to the parent company, this generate a capital outflow in the host country.

On the host markets level, there is an increase and a diversification of local supply. This can be good for consumers, but local companies can lose market share and even go bankruptcy.

Many cases of corruption in host countries related with foreign direct investment have been observed. This is caused by bribes from parent companies to local government officials. (1)

Facts

Countries that most foreign direct investment generated during the last years are:

- United States

- Japan

- Hong Kong

- Germany

- China

Countries that most foreign direct investment received where:

- United States

- China

- Hong Kong

- Belgium

- England

If we compare outflows vs inflows, countries which made most FDI where:

- United States

- Japan

- Germany

- France

- Switzerland

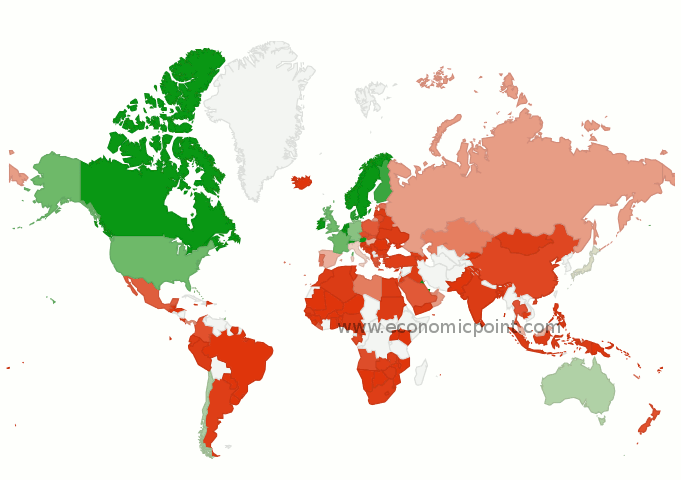

Taking into account per capital flows, we can observe in the following map what countries generated more FDI (green: more FDI per capita).

We can see that the economic regions that generated more net foreign direct investment per capita were:

- Nordic countries (Finland, Sweden, Norway).

- Non latin western european countries (Germany, France, England, Netherlands, etc.).

- North-America (Canada and USA).

- Australia

- Japan and Chile

Financial Foreign Investment

Financial foreign investment is the investment of funds by individuals, companies or government in financial assets (shares, bonds, etc.) of another country.

Financial foreign investment doesn’t entail active management of foreign companies. The shareholder of foreign financial assets is “passive”, in the sense that he just receive dividends, but doesn’t have any influence in managerial decisions.

Financial foreign investment doesn’t generate transfers of technology.

References

(1) see http://www.bloomberg.com/news/articles/2013-05-02/ibm-says-justice-depar… , http://www.sec.gov/News/PressRelease/Detail/PressRelease/1365171575006 , http://www.sec.gov/news/press/2011/2011-263.htm , http://www.ft.com/cms/s/0/fc76fe62-ef9d-11e2-a237-00144feabdc0.html , http://www.sec.gov/news/press/2007/2007-230.htm