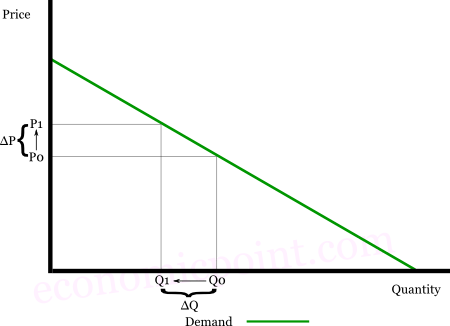

The elasticity of the demand shows the responsiveness of the quantity demanded to a change in the price.

It is defined as the proportional change in the quantity demanded, divided the proportional change in the price.

e = (ΔQ/Q)/(ΔP/P)

When the price increases (+), the quantity demanded decreases (-): the demand elasticity is usually negative.

Graphically:

How to Calculate the Demand Elasticity

Method 1: starting point

The price of ice cream has increased from $10 to $12. As a consequence, the demand has decreased from 100 pounds daily sales, to 90 pounds daily sales.

To find out the demand elasticity, we find the percent change in the quantity demanded: ΔQ/Q = -10/100 = -0.1

The percent change in the price is: 2/10 = 0.2

And the elasticity is: -0.10 / 0.20 = -0.50

Method 2: midpoint or arc elasticity

Using the arc elasticity method, the base quantity and price are the averages:

- The average quantity is: (100+90)/2=95

- The average price is: (10+12)/2=11

The percent change in quantity, according to the arc elasticity method is: -10/95=0.105

The percent change in price is: 2/11=0.182

And the demand elasticity is: -0.579

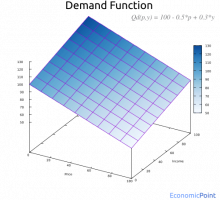

Method 3: point method

The formula of the demand elasticity is:

e = (ΔQ/Q)/(ΔP/P)

And can be rewritten as:

e = (ΔQ/ΔP).(P/Q)

If the quantity demanded is a continuous function of the price Qd=f(P), the formula can be rewritten as:

e = (dQ/dP).(P/Q)

Where (dQ/dP) is the derivative of the quantity with respect to the price.

Using the given data, and assuming that the demand is a linear function with the form of Q = a - b.P , we can find that the demand function is:

Q = 150 - 5P

If we are asked to measure the elasticity of demand when the price is 10 using the point method, we take the first derivative of the demand function: dQ/dP = -5 (It is just the slope of the function).

And the demand elasticity is e = -5 . 10/100 = -0.50

Determinants of the Demand Elasticity

- Availability of close substitutes: the more substitutes, the higher the elasticity.

- The higher the participation of the income used to pay for the good, the higher the elasticity.

- Long run vs. short run: the demand elasticity is higher in the long run.